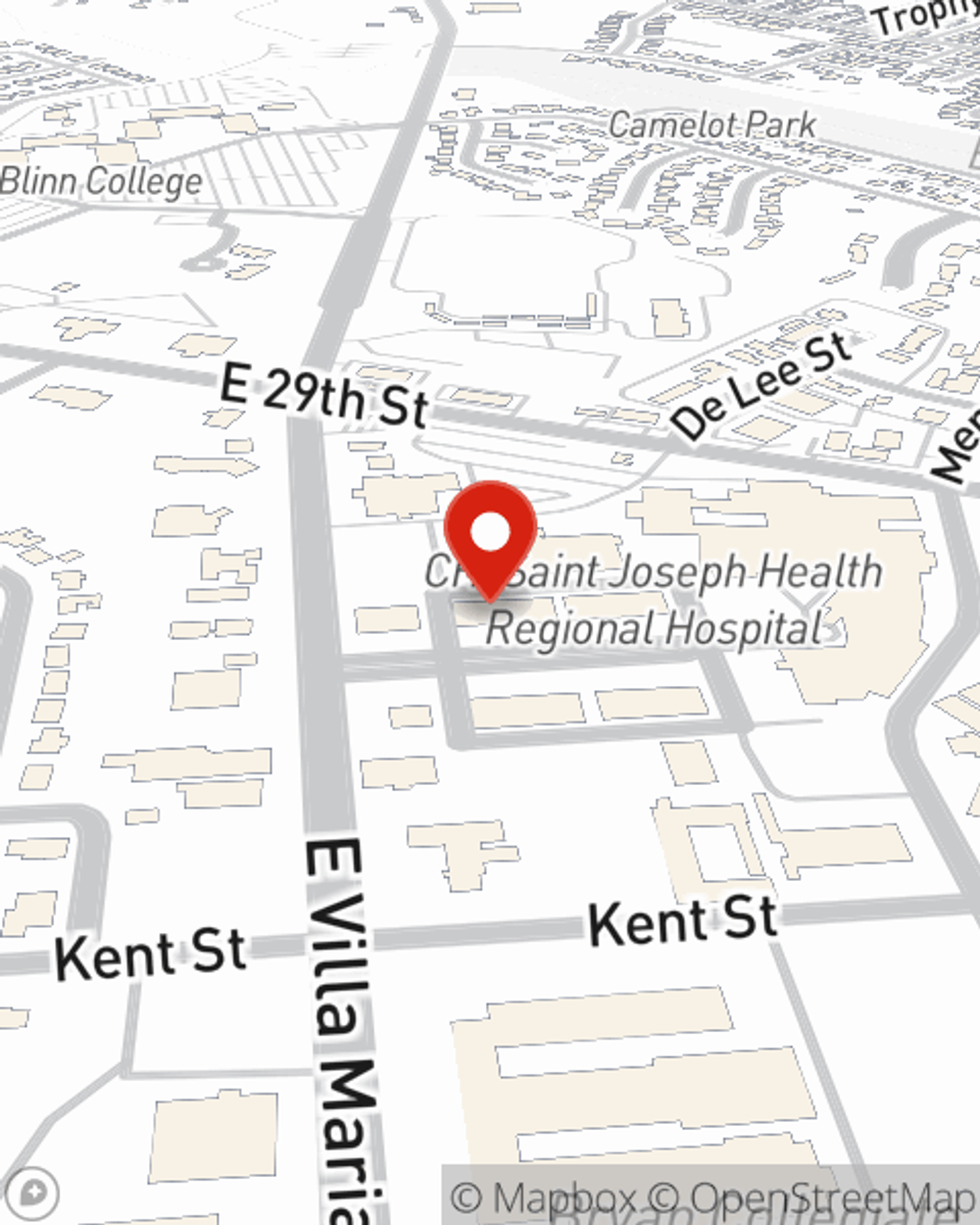

Condo Insurance in and around Bryan

Looking for excellent condo unitowners insurance in Bryan?

Cover your home, wisely

Home Is Where Your Condo Is

When looking for the right condo, it's understandable to be focused on details like location and neighborhood, but it's also important to make sure that your condo is properly insured. That's where State Farm's Condo Unitowners Insurance comes in.

Looking for excellent condo unitowners insurance in Bryan?

Cover your home, wisely

Agent Courtney Boring, At Your Service

With this insurance from State Farm, you don't have to be afraid of the unexpected happening to your unit and personal property inside. Agent Courtney Boring can help inform you of all the various options for you to consider, and will assist you in building an excellent policy that's right for you.

Want to learn more about the State Farm insurance options that may be right for you and your condo? Simply get in touch with agent Courtney Boring's team today!

Have More Questions About Condo Unitowners Insurance?

Call Courtney at (979) 704-3288 or visit our FAQ page.

Simple Insights®

How to throw a safe house party

How to throw a safe house party

Learn tips about hosting a safe party at home, respecting your neighbors when you have parties and minding noise pollution laws.

House hunting

House hunting

House hunting can be a time-consuming process, but with some research and foresight, you may be able to avoid wasted time and expensive risks.

Courtney Boring

State Farm® Insurance AgentSimple Insights®

How to throw a safe house party

How to throw a safe house party

Learn tips about hosting a safe party at home, respecting your neighbors when you have parties and minding noise pollution laws.

House hunting

House hunting

House hunting can be a time-consuming process, but with some research and foresight, you may be able to avoid wasted time and expensive risks.